What Texas Land Buyers Are Actually Paying Attention To in 2026

Investors. Builders. Sellers. Same state, very different priorities.

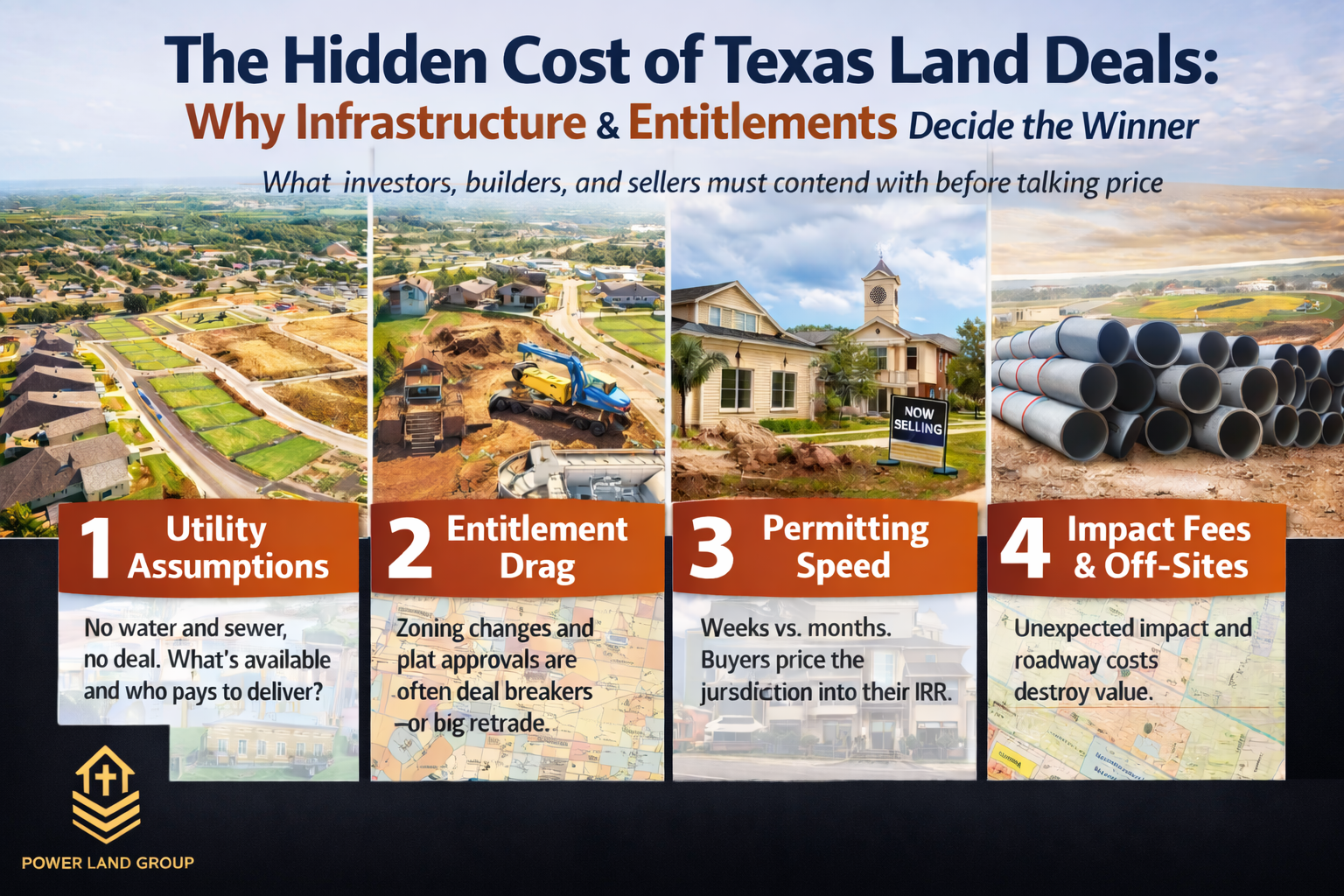

Texas land is still a magnet, but the underwriting has changed. Higher cost of capital, tighter entitlement timelines, and infrastructure constraints mean the "good deals" are not just cheap dirt anymore. They are buildable, serviceable, and financeable dirt.

Texas A&M's Real Estate Research Center has been describing a market that is less frothy than the peak years, but holding up with resilience, even while sales volume has cooled in many areas.

Below is a ranked, SEO-friendly breakdown of what each group is focusing on right now, so you can price, package, and position land the way the market rewards.

The 7 land factors Texas investors are prioritizing (ranked)

-

Execution risk (entitlements + timeline certainty)

Investors are pricing deals less on "potential" and more on how fast you can get to vertical. If the path is clear, survey, access, utility availability, and a realistic permitting schedule, the land is worth more.

Why this is rising: permitting speed plus construction cost volatility impacts IRR, and builders are increasingly cautious about future starts.

-

Basis vs. replacement cost (can I still make money at today's debt cost?)

Texas A&M's outlook includes continued sensitivity to rates and what that does to buyer demand and deal math. Land investors are underwriting more conservatively: more buffers, lower exit assumptions, tighter contingencies.

-

Exit liquidity (who is the buyer, today?)

A deal is only a deal if there are buyers at the finish line. In many metros, Texas remains a major engine for new-home permits and builder activity.

-

Infrastructure: water + power

Water and power access is not "nice to have" anymore, especially near growth corridors and big loads (industrial and data centers). ERCOT demand growth pressures are increasingly part of the siting conversation for major projects.

-

Price per acre is not the metric, price per buildable unit is

Sophisticated buyers care about net developable acres, lot yield and density, detention and drainage cost, offsite requirements, and per-lot basis after soft costs.

-

Legal defensibility (title, access, restrictions, mineral and water considerations)

Due diligence is getting deeper, especially around groundwater management and local controls. Texas groundwater is managed through local groundwater conservation districts, with TWDB oversight of management plans.

-

Submarket fundamentals (migration + job drivers)

Population inflows and job drivers still matter because they create absorption. Texas continues to show strong in-migration signals.

The 7 land factors Texas builders are prioritizing (ranked)

-

Shovel-readiness

Builders will pay premiums for land that is clean title plus survey in hand, utilities confirmed (not "available nearby"), clear access and easements, and a realistic approvals path.

-

Finished-lot pipeline and permitting throughput

Some jurisdictions are working to speed reviews (including AI-assisted pre-checks in certain areas), because review timelines have become a real constraint.

-

Lot size + product fit

Builders are aligning land buys to what moves now and what lenders will still like. This is why you are seeing more interest in infill lots, smaller-lot product, and phased takes.

-

Cost certainty

Material, labor, and regulatory costs are still pressures. Builders do not want surprise scope creep.

-

Utility and impact-fee clarity

If the numbers are not documented and defensible, builders either reduce price, force longer option periods, or walk.

-

Community acceptance + site constraints

Drainage, access, traffic, trees, floodplain, protected features, builders want known knowns.

-

Take-down flexibility

More builders want phased closings, rolling option releases, and performance-based price steps.

The 7 land factors Texas sellers are focusing on (ranked)

-

Net proceeds and certainty to close

Sellers want to avoid tire-kicker offers. Clean documentation plus realistic timelines attract higher-quality buyers.

-

Tax strategy (especially 1031 exchanges)

Many sellers weigh whether to defer gains through a 1031 exchange (federal rules apply).

-

Price transparency

Sellers are learning the hard way: the highest-price offer is not always the best offer if timelines, offsite costs, or approvals are shaky.

-

Simple terms (options, earnest money, feasibility periods)

They prefer shorter options, clearer milestones, and a buyer who can explain the process.

-

Reputation and relationship

Local sellers (especially generational owners) care who is buying and what will happen to the land.

-

Splitting, partial sales, and retained acreage

Sellers are increasingly open to creative structures if it improves net outcomes.

-

Risk transfer

Who pays for surveys, environmental, engineering, utilities, and offsites? The tighter the market, the more sellers push that onto buyers.

What PLG watches when we evaluate Texas land

At Power Land Group (PLG), we focus on buildability plus financeability plus clean execution across the Texas growth corridors, especially San Antonio, Austin, and DFW, because that is where buyer demand and infrastructure investment are colliding the fastest.

Texas A&M data continues to show rural land markets behaving with resilience even as activity stays below pre-pandemic highs, which reinforces a selective, fundamentals-first approach.

Want a land value and disposition opinion in 24 to 48 hours?

If you have a parcel you are considering selling or entitling, PLG can provide:

- a quick positioning plan (builder vs. investor vs. retail)

- a price range based on buildable yield and market demand

- a buyer-ready deal pack outline (what serious buyers ask for)

Reply LAND through our contact page or DM us and we will send the intake checklist.